If you’re a company director — or advising one — understanding Director Penalty Notices (DPNs) is critical. Issued by the ATO, these notices make directors personally liable for company tax debts. That’s a heavy responsibility, especially when the notice arrives unexpectedly.

This guide breaks down the different types of DPNs, what they mean, and the steps that can (or must) be taken to manage them.

It’s a bit of a long one guys, so if you’re reading this and have received a DPN, give us a call first.

What Is a DPN?

A DPN is a formal notice from the ATO that attaches a company’s tax debts to its directors personally. It typically relates to PAYG, GST, or superannuation guarantee charge (SGC) debts.

The notice is sent to the director’s home address, as listed in ASIC records and outlines:

The company name

The tax debt the DPN relates to GST, PAYG, SGC

The relevant tax periods

The amounts reported vs. unpaid

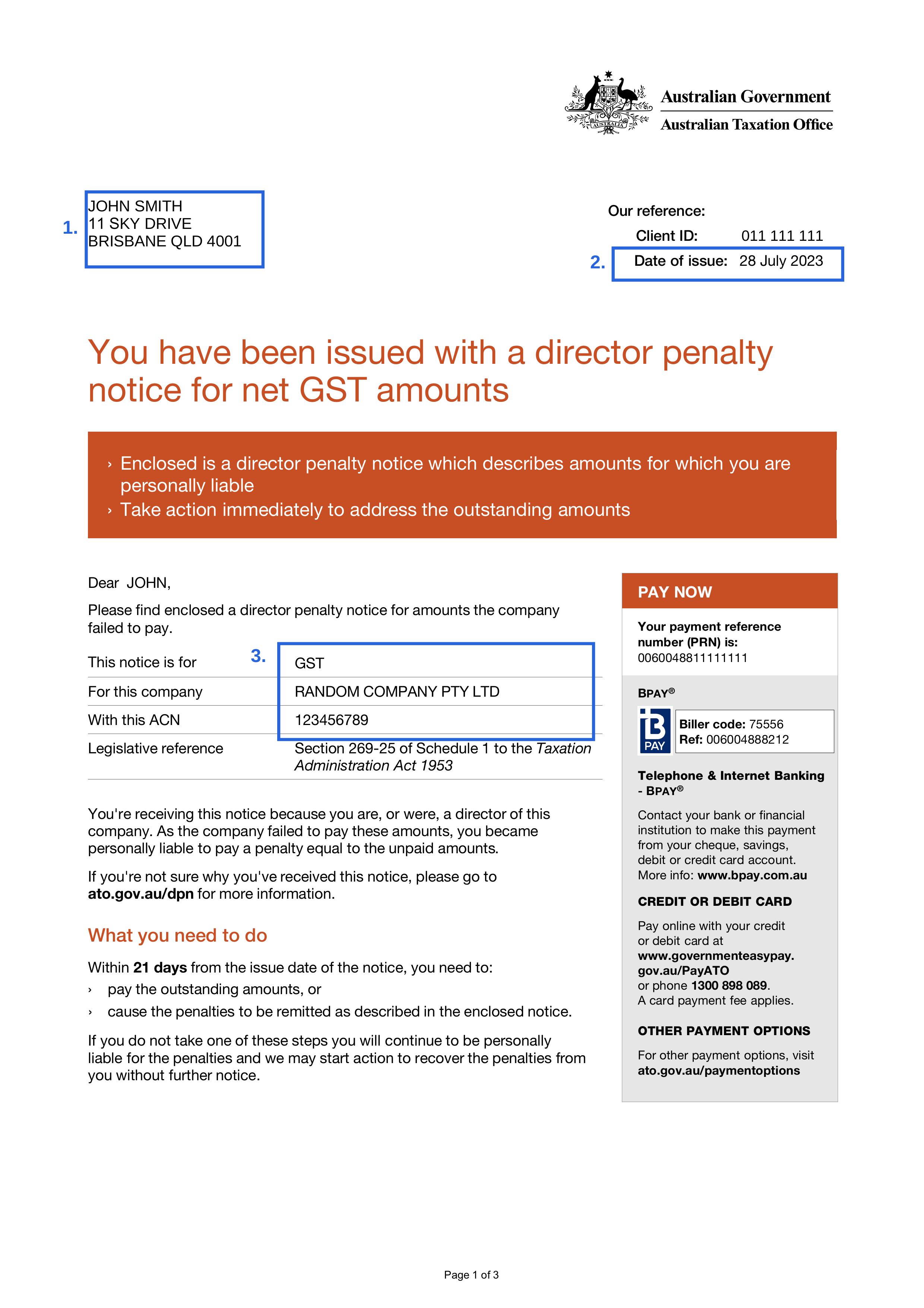

What does a DPN look like

The first two pages of the notice are always the same, except for the description of what the notice is for. In the example below, the notice was issued for GST. However, it will change for PAYG and Superannuation.

Key points on the below:

The DPN is issued to the Director personally. A DPN is issued to their home address per the current ASIC record. The DPN does not go to the Company registered office, or their accountant.

The DPN will also show up on the Directors personal ATO portal once it is issued. A copy of the letters can be found in their personal portal too.This is the Key date in the case of a non-lockdown DPN the Director has 21 Days from this date to take action.

This provides details of what the DPN is for and the Company it relates to.

Page two contains details on how to dispute and where to make payment.

Even though the first two pages always state that the director has 21 days, this is misleading for lockdown DPNs. With a lockdown DPN there is no way for the Director to remit the penalty other than paying the debt. The director may still enter a payment plan, but this won’t remove the liability. In our view the 21 days is more about engaging with the ATO to prevent further collection action, than the Director having options to remit the penalty.

Even though the first two pages always state that the director has 21 days, this is misleading for lockdown DPNs. With a lockdown DPN there is no way for the Director to remit the penalty other than paying the debt. The director may still enter a payment plan, but this won’t remove the liability. In our view the 21 days is more about engaging with the ATO to prevent further collection action, than the Director having options to remit the penalty.

Lockdown vs. Non-Lockdown DPNs

There are two main types of DPNs:

🕒 Non-Lockdown DPN

If the company’s compliance is good and it has lodged its returns on time, the ATO may issue a non-lockdown DPN. This gives the director 21 days from the date of the letter to take one of the following steps:

Pay the debt in full

Appoint a small business restructuring practitioner

Appoint an administrator

Begin the process of winding up the company

If one of these actions is taken within the 21-day period, the penalty is remitted, and the director is relieved of personal liability.

🔒 Lockdown DPN

This applies when the company’s compliance history is poor and the director has not lodged on time (BAS or SGC). Once the lodgement remains overdue and unpaid for 3 months in the case of a BAS or on the due date in the case of SGC, the director is automatically liable for the debt.

The moment the lodgement goes overdue by the periods noted above, the lockdown DPN exists. Future lodgement of the outstanding BAS or SGC returns only crystallises the debt with the ATO.

The only option with a lockdown DPN is to pay the debt in full. Administration, liquidation, or an SBR won’t remit the penalty.

DPN Examples

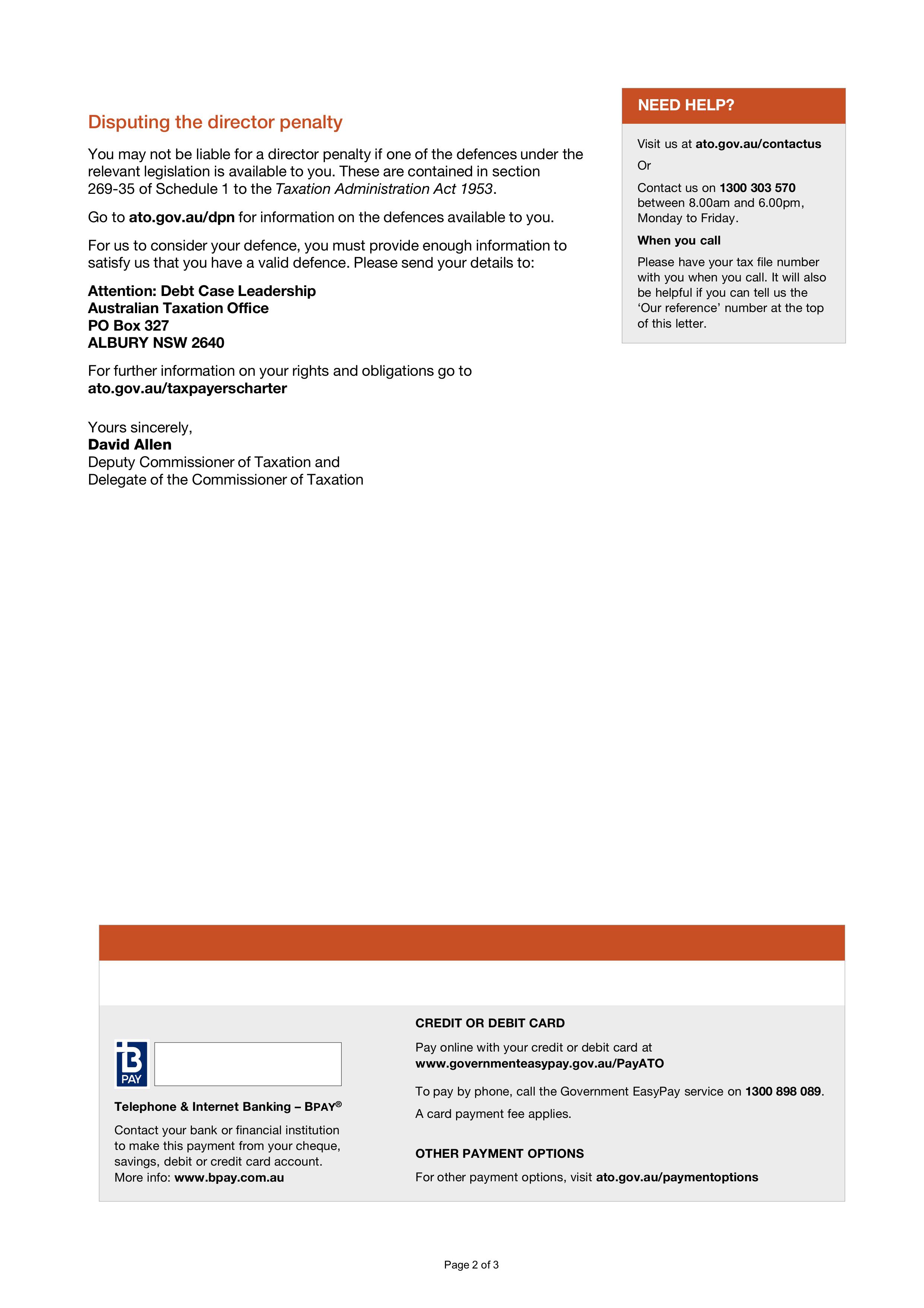

Non-lockdown

The below is a copy of a Non-Lockdown DPN. Key sections include:

Reflects the tax debt the DPN relates to - PAYG in this case.

Column 1 will always reflect the specific periods the ATO is issuing the DPN for.

Column 2 represents the amounts reported to the ATO for the respective periods.

Column 3 reflects the amounts the ATO believes remain outstanding for the relevant periods. They are often the same as Column 2, however, in this example you can see small amounts have been paid on each period.

This is what distinguishes a Non-Lockdown DPN from a lockdown. A non-lockdown DPN will contain this section, giving the Director 4 options, A, B, C, D. If the notice is only 3 columns and contains this section it is Non-Lockdown and the Director has 21 days to take one of those steps.

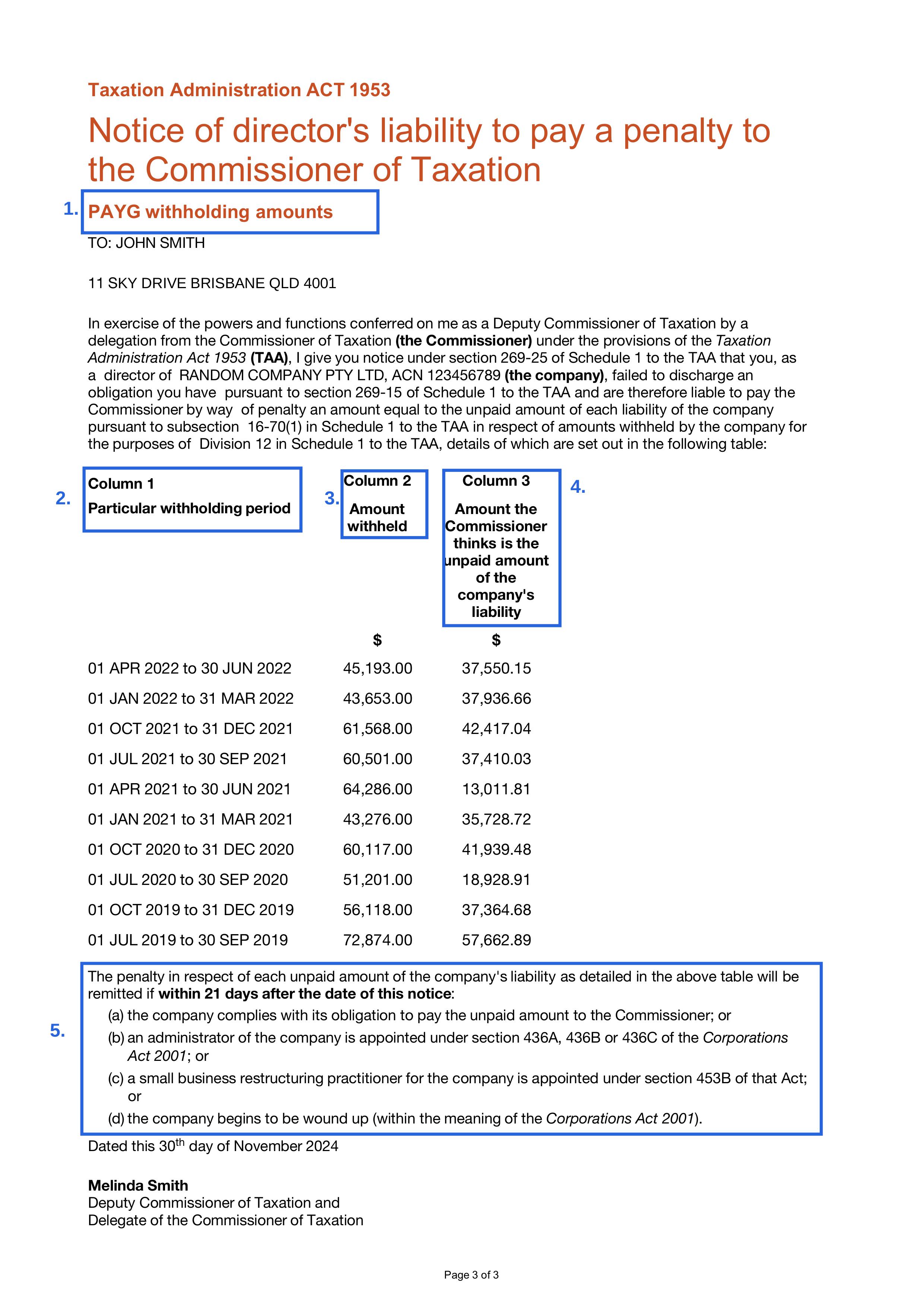

Lockdown DPN

Lockdown DPN

Our next example is a lockdown DPN. The key areas of this DPN are similar to the prior example.

Columns 1, 2 and 3 are exactly the same as the prior DPN.

This is where you can tell it is a Lockdown DPN. The notice does not provide the director with the options shown in the prior notice. There is no A, B, C, D. The only option for the Director is to pay the debt.

As noted early, while this DPN does say the Director has 21 days, the reality is the only way for the Director to deal with the DPN is to pay the debt. There are no steps they can take in the 21 days to remit the penalty, hence the term lockdown DPN. Sure if the debt is paid in 21 days, the DPN is extinguished, but the same is true if the debt was paid in 6 months.

Combined DPNs

Combined DPNs

There is a third type of DPN that the ATO issues, which is a combination of both lockdown and non-lockdown debts listed.

The quickest way to identify this type of notice is that it contains 5 Columns. To understand notice:

As with the last two examples, columns 1, 2 and 3 are the same.

Column 4 reflects Non-Lockdown amounts. Lodgements which were made on time.

Column 5 represents the Lockdown amount.

This section specifically relates to Column 4 of the notice. Only amounts contained in Column 4 can be remitted by taking one of the steps outlined. These are Non-Lockdown amounts.

This section specifically relates to Column 5. Amounts in Column 5 are Lockdown amounts.

In this example, if the Director took one of the steps A to D within 21 days of the notice they would have achieved remission of $76,000 of the DPN but remained liable for the $51,700 amount.

.jpg)

For Accountants and Lawyers

If you work with company directors, recognising the type of DPN they’ve received — and the urgency involved — is vital. DPNs are time-sensitive, and directors risk exposing their personal assets by waiting too long.

Knowing whether the debt falls under lockdown or non-lockdown rules helps you guide your clients.

In the case of a non-lockdown DPN the Director has 21 days from the date of the notice to take one of the steps in the notice to have the DPN remitted.

Importantly - a payment plan with the ATO will not remit the personal liability.

I often have Directors, or accountants, tell me they’ve spoken to the ATO and have entered a payment plan. That’s a great step, and if the company pays the full debt, the DPN is extinguished.

However, in our experience, companies that fall behind with the ATO and have a history of non-compliance, often have deeper structural problems. It is generally not a one off event, but a fundamental issue with the business operations.

If the payment plan defaults and the Company has to consider insolvency options at a later date. The Director will remain personally liable for the residual amounts owing on the Director Penalty Notice. Unfortunately in the worst case, this means a director would need to consider bankruptcy to deal with the personal liability.

Had they sought advice, or been advised of, and considered, the alternatives when the DPN was received, this could have been avoided.

We're Here to Help

At Resolv, we specialise in helping directors manage the consequences of DPNs. Whether you’re a director yourself or advising one, we’ll provide:

A clear review of the notice.

Practical advice on what steps to take.

A plan that protects the director’s interests.

We know this can be stressful. Our role is to help you move forward — calmly, confidently, and with the right information.

If you want to know the best practices to avoid a DPN in the first place, check out this article.

Finally - if you have received a DPN call us now!